MOE Federal Reductions

Under Federal regulations, an LEA may be able to reduce its level of MOE expenditures by not more than 50% of any increases in IDEA Part B Section 611 funding, with exceptions and conditions.

For example, if an LEA received $100,000 in this funding in the prior year, and $150,000 in the current year, the LEA may be able to reduce its level of MOE expenditures by not more than $25,000 (which is $150,000 less $100,000; and then multiplied by 0.50).

| Item | Amount |

|---|---|

| Current year funding (IDEA Section 611 Local Assistance Grant Award - Resource 3310) | $150,000 |

| Less: Prior year's funding (IDEA Section 611 Local Assistance Grant Awards - Resource 3310) | $100,000 |

| Increase in funding (if difference is positive) | $50,000 |

| Maximum available for MOE reduction (50% of increase in funding) | $25,000 |

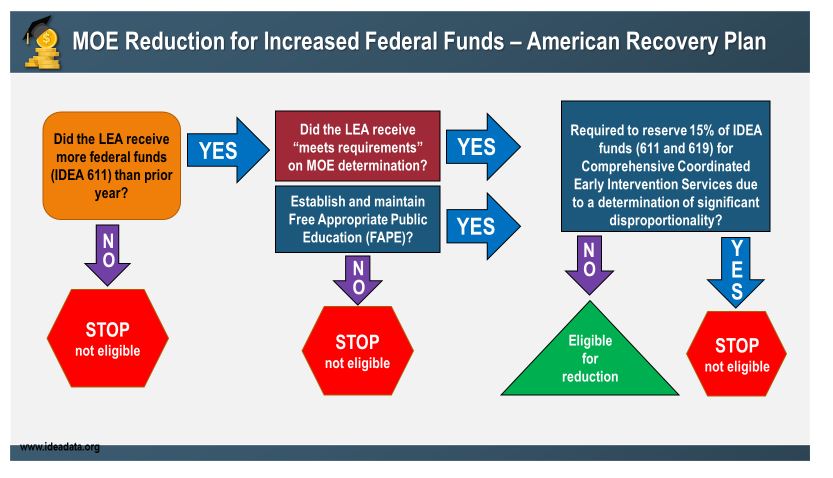

There are exceptions and conditions to this reduction:

- This option is available only to LEAs that have a "meets requirements" compliance determination and that are not found significantly disproportionate for the current year. Please note that most LEAs do not have a "meets requirements" determination.

- This option is available only if the LEA used, or will use, the free-up funds for activities authorized under the Elementary and Secondary Education Act (ESEA) of 1965. The LEA will need to identify this use of the freed-up funds.

- The amount of Part B funds used for early intervening services (34 CFR 300.226(a)) will count toward the maximum amount by which the LEA may reduce its MOE requirement under this exception (P.L. 108-446). Use the calculation found in SACS to determine the amount.

Use the following chart to determine if the LEA is eligible.

If the LEA qualifies, please contact the Fresno County SELPA for further instructions and guidance.